Financial DNA Mapping

Physical DNA Mapping

DNA contains the biological characteristics that make you unique.

“Genetic mapping…can offer firm evidence that a condition transmitted from parent to child is linked to one or more genes. Mapping also provides clues about which chromosome contains the gene and precisely where the gene lies on that chromosome.” - National Human Genome Research Institute

During the process, scientists examine DNA to identify unique patterns that are commonly seen in family members who have specific traits. These characteristic patterns are referred to as DNA markers.

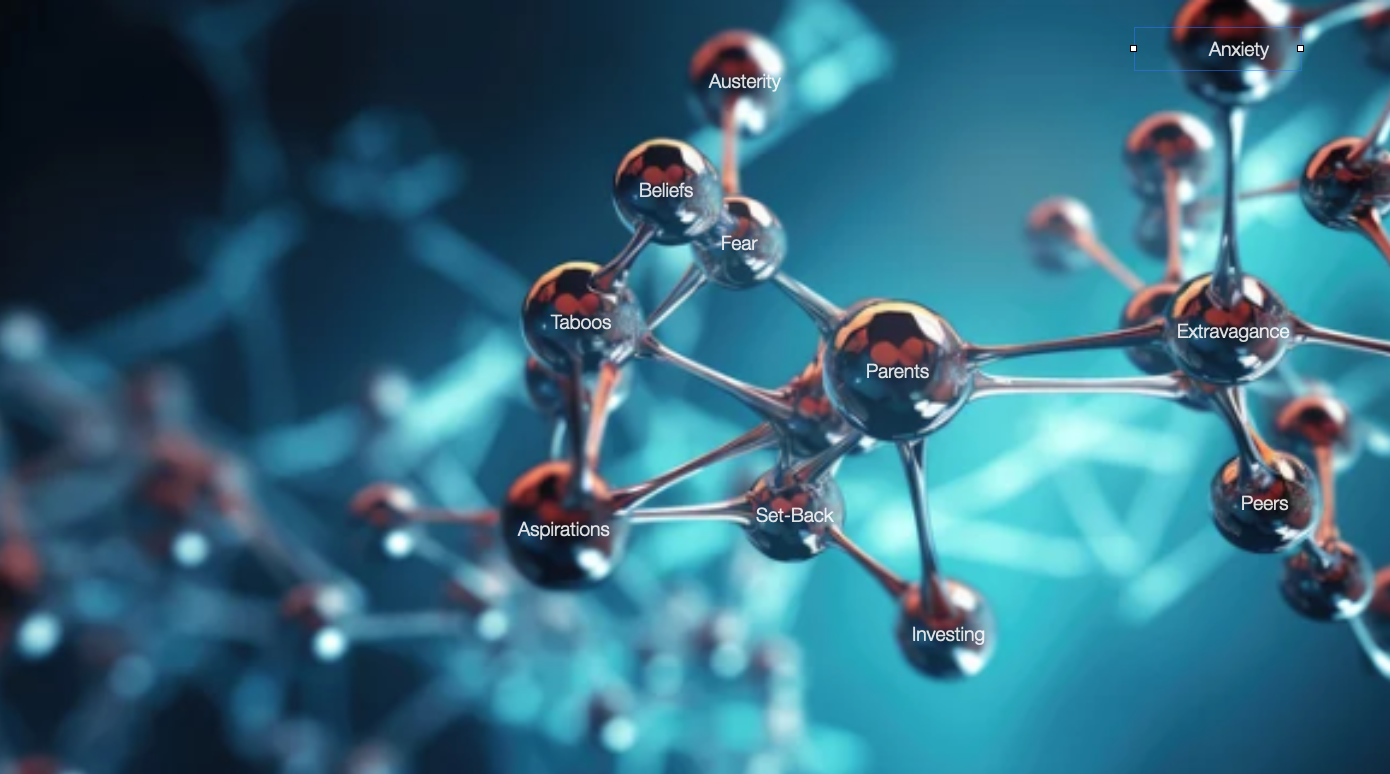

Financial DNA Mapping

Mapping your Financial DNA involves developing a comprehensive picture of your past and current financial characteristics (Beliefs, experiences, habits, strengths, and weaknesses) that could inform your future financial decisions. The process enables the identification of key financial drivers. The benefits of Mapping your Financial DNA include uncovering:

Your drivers for good vs. bad financial decisions

Your propensity toward austerity or extravagance

Your financial beliefs and taboos

Our Approach

Our Approach focuses on using the same processes and tools that drive success for major brands and corporations. This includes taking you through Discovery, Analysis, Planning, and Execution phases.

-

Discovery: Your journey to Financial Emancipation begins with the discovery phase, where we explore your needs and expectations. During this phase, we’ll help you identify your current financial geography as well as your key objectives. We’ll ask relevant questions to seek an understanding of your specific circumstances. The discovery phase sets the foundation for future work sessions and helps us gain important insights to help you map your journey.

-

Analysis: Once your financial geography and future objectives are identified, the analysis phase commences. We’ll conduct an assessment of your current financial situation, helping you gather relevant information and analyze key factors that may influence your journey. This analysis may include a SWOT (Strengths, Weaknesses, Opportunities, and Threats) assessment, an Internal and Professional Team review, and may also involve examining other pertinent information. The objective is to gain a more holistic view of where you are and where you want to be.

-

Planning: Armed with insights from the analysis phase, we’ll move into the planning phase. Here, we collaborate closely with you to lock down your objectives and develop a strategic plan that aligns with your goals and addresses identified challenges. This involves: outlining specific deliverables, establishing realistic timelines, and allocating necessary resources. The planning phase aims to create a roadmap that guides you toward achieving your desired outcomes effectively and efficiently. It may also involve exploring alternative approaches, considering risks and contingencies, and ensuring feasibility and alignment with your overall destination - Financial Immortality.

-

Execution: With your plan in place, you’ll move forward to the execution phase. This stage involves the implementation of the strategies and activities outlined in the planning phase. This is when you’ll begin executing the plan, coordinating tasks, and ensuring smooth progress. Key to your success will be maintaining open lines of communication with your Internal and Professional Teams, establishing regular status updates, achieving key milestones, as well as making any adjustments along the way. The execution phase emphasizes collaboration, proactive problem-solving, and agile decision-making to address emerging challenges promptly.

Your Portal & Tools

Expense & IPA Income

Credit Management

Professional Team

Strength & Capabilities

Our project management approach will help you set important goals, track critical items, and meet crucial milestones.

What clients are saying…

“Finally, a practical approach to building generational wealth that was tailored to my individual needs and abilities. Planning and implementation of my Financial Immortality System was fast and easy.”

— Duane & Layton George, Real Estate Investors, New York, NY

“Working with Financial Immortality Systems was an epiphany. In a few short weeks, I had a clear roadmap showing us how to restructure our current real estate holdings as well as an approach to future acquisitions. Thank you so very much for showing us what’s possible.”

— Genia Hale, M. Ed., CEO, Technocational Design, Austin, TX

“Our Strategy sessions provide me with an easy-to-understand, actionable approach that helps prioritize immediate next steps. I’m able to develop practical methods to meet critical milestones.”

— Taylor Fulton, Technologist, Apple, Atlanta, GA

Get Started…

The Financial Emancipation System is your Foundational System and the initial step toward achieving Financial Immortality.

What you get with this system…

-

1. Conduct Expense vs. IPA Income Analysis

- The Output > Your Financial Emancipation Score and Roadmap

2. Conduct Credit Management Analysis

- The Output > Your Credit Management Action Plan

3. Conduct Team & Resource Management Analysis

- The Output > Your Professional Team & Resource Management System

4. Conduct Strengths & Opportunities Analysis (SWOT)

- The Output > Your Strengths & Opportunities Action Plan

-

Your system and materials are located within an online, collaborative, secure, and encrypted workspace built on the SmartSheet platform. The portal enables document storage, team communication, and the establishment of a single source of truth.

-

A personal FIS Project Manager (16 Hours) to help set up your system and provide one-on-one follow-up to help you meet deadlines and achieve your key milestones.

-

Your coaching sessions cover;

Your Current Expenses vs. Income Producing Assets (IPA) Assessment

Your Credit Management System

Your Professional Team & Resource Management System

Your Strengths & Capabilities Assessment